Post-kaiser Family Foundation Poll April 13-may 1, 2017,

Early in the COVID-nineteen pandemic, information technology was not clear how healthcare utilization and spending would modify. Although one might expect health costs to increase during a pandemic, there were other factors driving spending and utilization downwards.

In leap of 2020, healthcare use and spending dropped precipitously due to cancellations of elective care to increase hospital capacity and social distancing measures to mitigate customs spread of the coronavirus. Although telemedicine apply increased sharply, it was not enough to recoup for the drib in in-person care. As the year progressed, healthcare use and spending began to rebound as in-person care resumed for infirmary and lab services and COVID-19 testing became more widely available. Still, overall health spending appears to have dropped slightly in 2020, the kickoff time in recorded history.

As of December 2020, health services spending was down about ii.7% (seasonally adjusted annual rates) and it remained suppressed in January 2021. When calculation in spending on prescription drugs, full health spending was down by just near i.5% as of December 2020 compared to the aforementioned time in 2019. The U.South. Gdp fell by iii.v% by the terminate of 2020, meaning that, although health spending dropped, it probable represented a larger share of the economy than in past years.

The drop in health spending in 2020 reflects a decrease in utilization for non-COVID medical care. Particularly early in the pandemic, it appears many people delayed or went without medical care they otherwise would have received. Although healthcare use picked up toward the end of the year, it was not plenty to compensate for the missed care earlier in the twelvemonth. Additionally, the cost of COVID-xix vaccine assistants will likely have an upwards upshot on claims costs in 2021, as several insurers noted in their rate filings to state regulators.

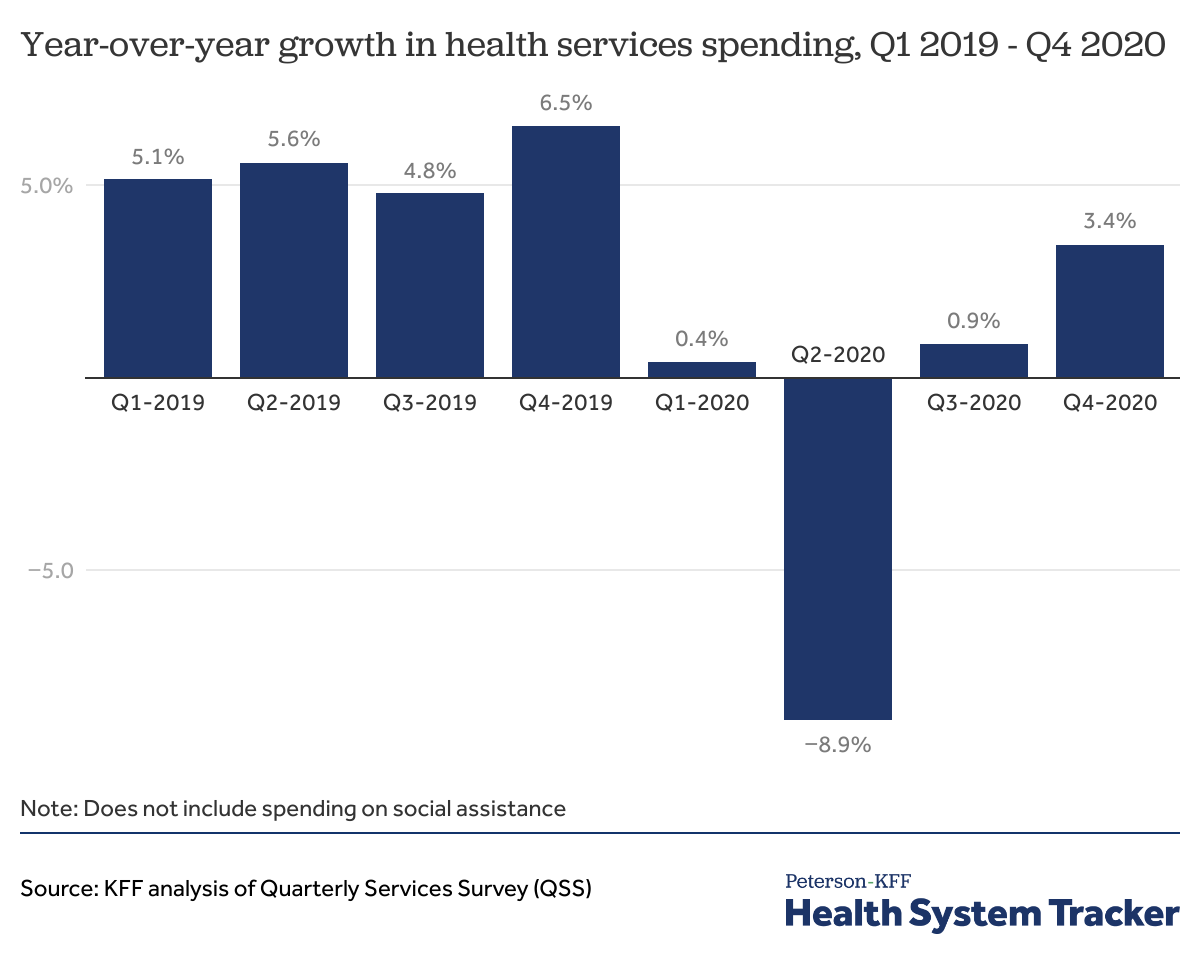

In 2020, health services revenue fell by i% compared to 2019

One fashion to look at health spending is to utilize the Quarterly Services Survey (QSS) information. Beyond all health services, which excludes prescription drugs and social services, health services revenue was down by -viii.9% in the second quarter of 2020 relative to the second quarter of 2019. In third quarter 2020, health services revenue was upwards by 0.9% from 3rd quarter 2019. In fourth quarter 2020, wellness services acquirement was upwards 3.4% relative to the quaternary quarter of 2019.

Although spending rebounded at the stop of 2020, health services spending was nevertheless down by about 1% in 2020 relative to 2019. The QSS data do not include spending on pharmaceuticals, which, as discussed more beneath, accept been spared from pandemic-related spending drops.

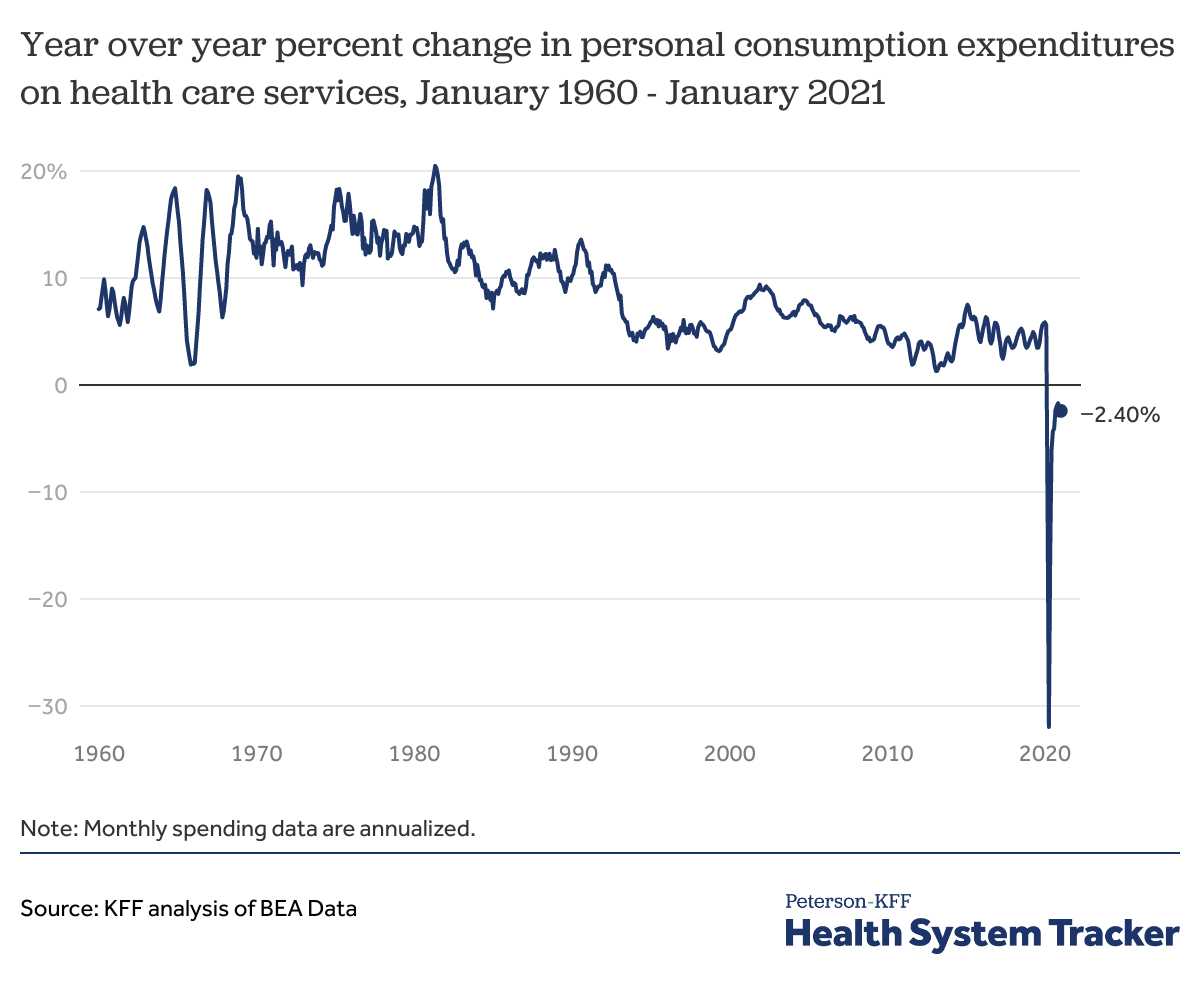

Spending on health services dropped sharply in March and April 2020, just has by and large recovered since

Another way to look at health spending trends is to utilize the personal consumption expenditure (PCE) data from the Agency of Economic Analysis (BEA), which is published monthly on an annualized basis. Like the QSS, the BEA'southward personal consumption expenditures (PCE) information show spending on health services was down sharply in spring 2020. (The monthly figures are estimates, and are later adapted, in office based on results from the QSS.)

At the nadir in April 2020, personal consumption expenditures on health services (not including pharmaceuticals) were downwards by -31.nine% on an annualized basis. This was unprecedented, as twelvemonth-over-year personal consumption expenditures on health services take grown every calendar month since the information became available in the 1960s. However, afterward plummeting in bound 2020, spending on wellness services has rebounded, and by January 2021, was down just -2.4% from the previous yr (seasonally adapted at annual rates).

The chart above does not include spending on pharmaceuticals and other medical products, which was up five.0% yr-over-yr in December 2020, and up 1.0% year-over-twelvemonth as of January 2021 over the same time the year earlier. Prescription drug acquirement has not suffered from the pandemic the manner health services acquirement has, every bit the latter fell largely due to social distancing and the delay or cancellation of elective procedures. Combined spending on health services and prescription drugs was down past -1.53% equally of December 2020, and by -2.two% as of January 2021 (seasonally adapted almanac rates, relative to the same month in the prior year).

Every bit of 4th quarter 2020, U.S. GDP was down by -three.5% (seasonally adapted at annual rates), relative to fourth quarter of 2019. This suggests health spending may represent a somewhat larger share of the economy in 2020 than in past years. The National Wellness Expenditure Accounts (NHEA) are the official source of health spending in the U.Southward. The NHEA counts a broader gear up of wellness-related spending compared to the BEA methodology. The NHEA data showed wellness spending every bit a percent of the U.Southward. economy was 17.7% in 2019. The NHEA estimates of health spending as a share of the economic system in 2020 volition exist updated later in the year. Based on BEA data, nosotros guess health spending as a percent of the U.S. economic system might have increased by 0.1 per centum points in 2020.

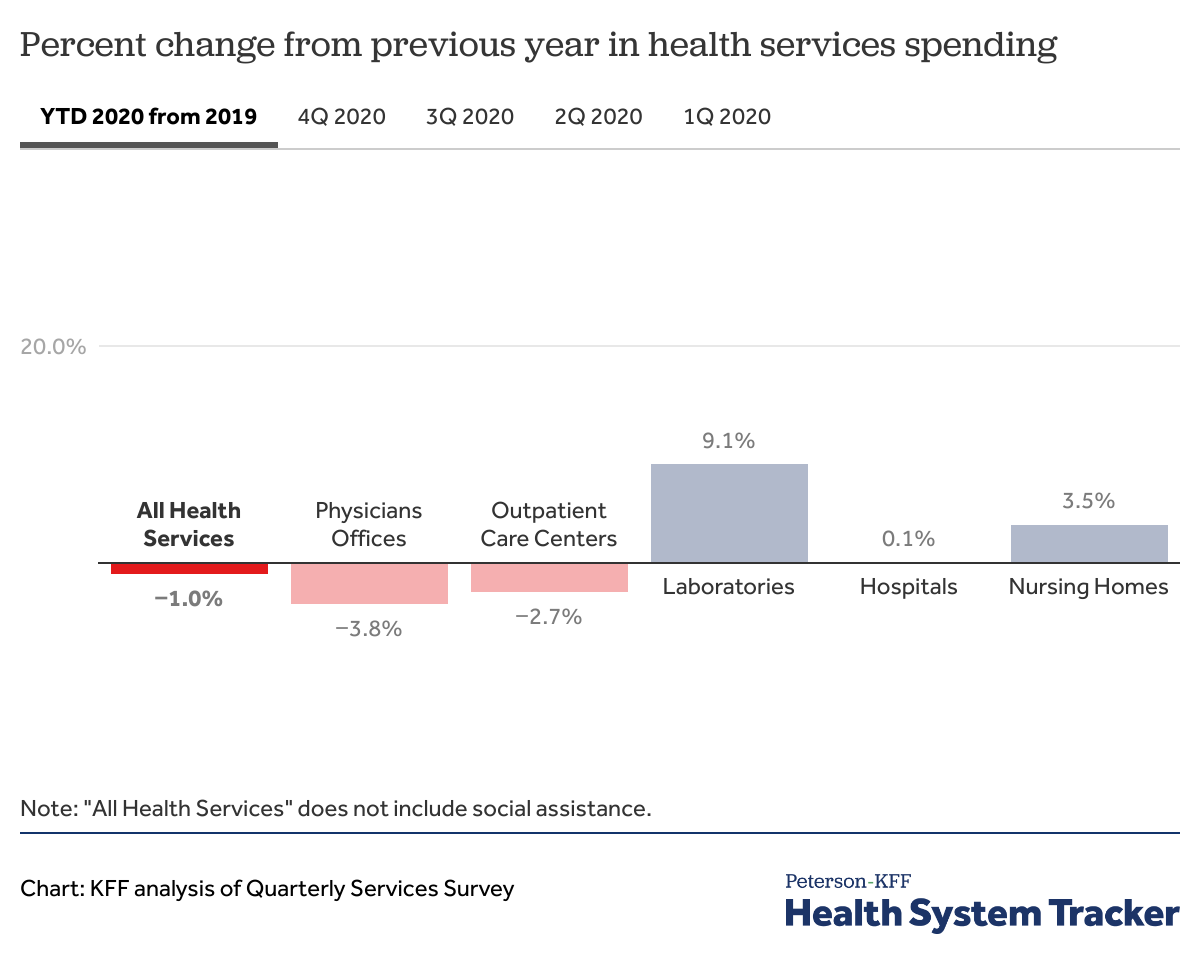

By the end of 2020, physician'southward office spending was still down from 2019

Through 2020, the Quarterly Services Survey shows that health services spending is downwardly by 1.0% relative to 2019. Convalescent care settings, similar physician offices (-3.8%) and outpatient intendance centers (-2.7%), saw drops in annual health acquirement, while revenue for labs and nursing homes increased and hospital revenue was about flat. Although not shown in this chart, dental providers have seen some of the largest drops in revenue amongst health services.

Equally tin can be seen past clicking on the quarterly revenue tabs in the chart above, acquirement for some health service providers has been volatile. For example, spending on medical and diagnostic laboratories was down by -14.v% in the 2nd quarter of 2020, but as COVID-19 testing became more than widely available through the year, spending on labs was up by 32.vii% in the fourth quarter year-over-year.

Similarly, infirmary revenue was downwards by -v.vi% in the 2d quarter of 2020, with the counterfoil of many elective procedures, simply revenue bounced back in the third and 4th quarters, rising 5.7% over the previous yr by fourth quarter 2020. On cyberspace, infirmary revenue was therefore more often than not unchanged in 2020 compared to 2019.

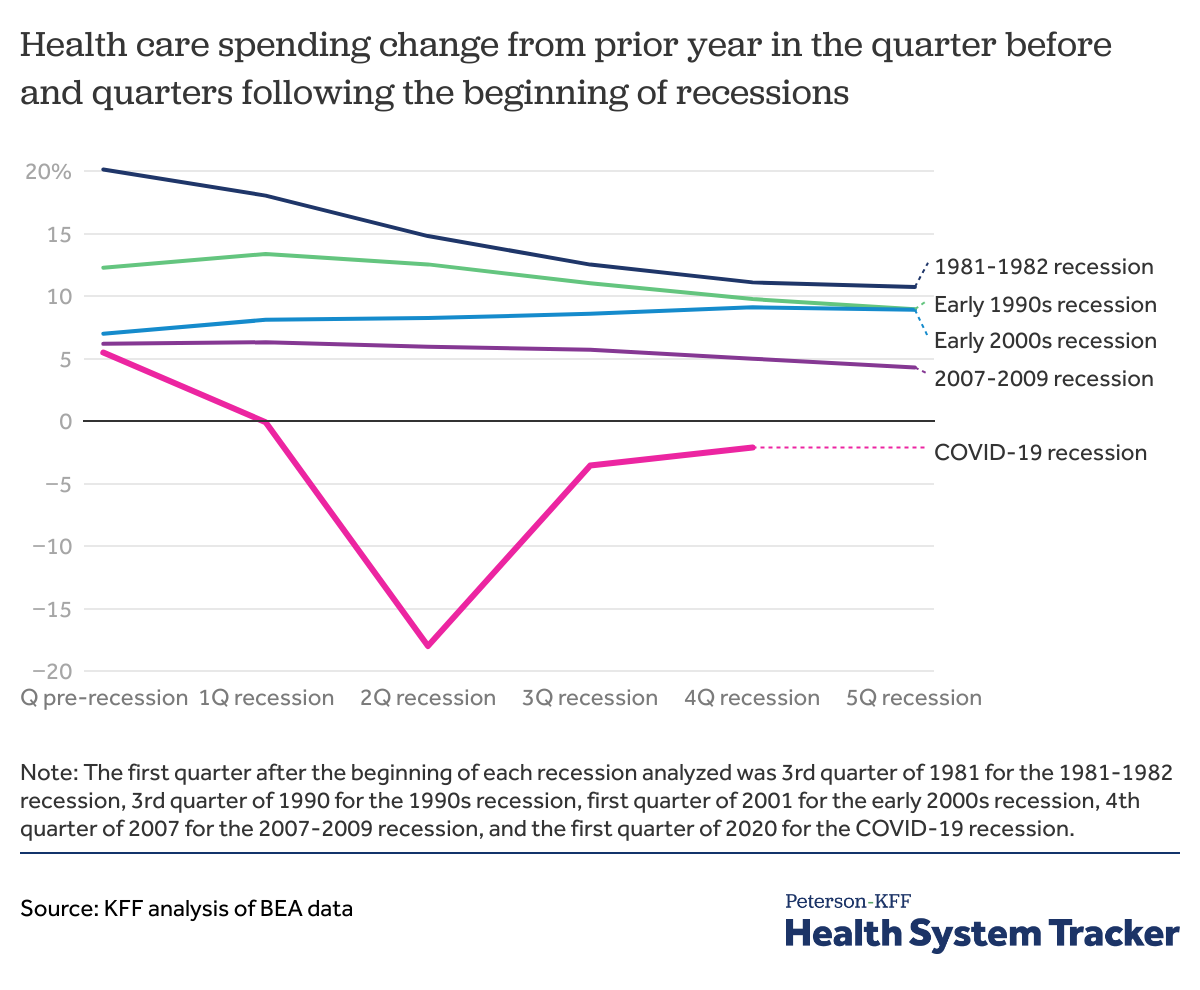

The COVID-19 recession is the outset recession during which health spending has decreased

Although social distancing and hospital capacity concerns were cardinal drivers of the drop in health spending in 2020, use of health services may have as well been suppressed due to affordability concerns amid the struggling economic system.

In the chart above, we compare health spending in the quarter before, the quarter of, and the 4 quarters following the beginning of a recession based on BEA quarterly data. In previous recessions, except for the 2000s recession, wellness spending growth slowed downward in the quarter following the first quarter of the recession, as compared to the same quarter of the previous year. Following the 2000 recession, twelvemonth-over-yr health spending growth increased from seven% in the quarter earlier to 9% in the fourth quarter relative to the aforementioned quarter in the year before.

Wellness spending growth has slowed down in the quarters post-obit the beginning of some recessions. However, the COVID-nineteen recession marks the first of the past 5 recessions to result in a subtract in wellness spending growth yr-over-twelvemonth. Health spending was downwardly -eighteen% in the second quarter of 2020 and stayed down at -ii.1% in the fourth quarter of 2020 over the prior yr.

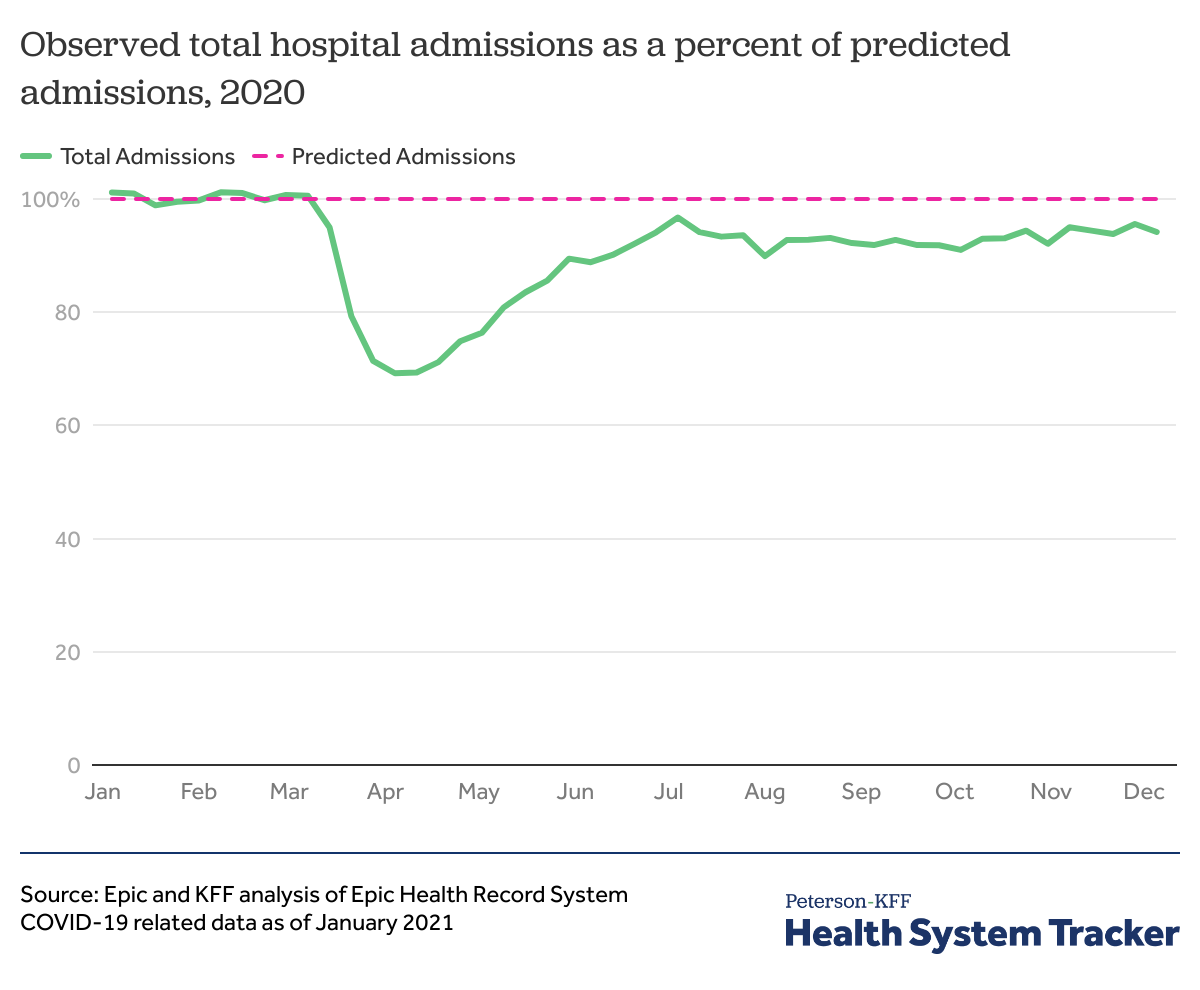

Infirmary admissions fell in the spring of 2020, but were back to near 94% by December

An analysis of hospital utilization data by Ballsy and KFF constitute that while hospitalizations had fallen in the bound of 2020, admissions had picked back upwards to about 95% of expected utilization (based on historical patterns) by July 2020. After dropping again to ninety% of expected admissions by August, overall admissions for the year rebounded to 94% of expected admissions every bit of December 5, 2020. As these data are merely available through early Dec 2020, information technology is non yet articulate how the latest spike in hospitalizations due to COVID-19 — which resulted in some hospitals once more reaching chapters — affected utilization into early on 2021.

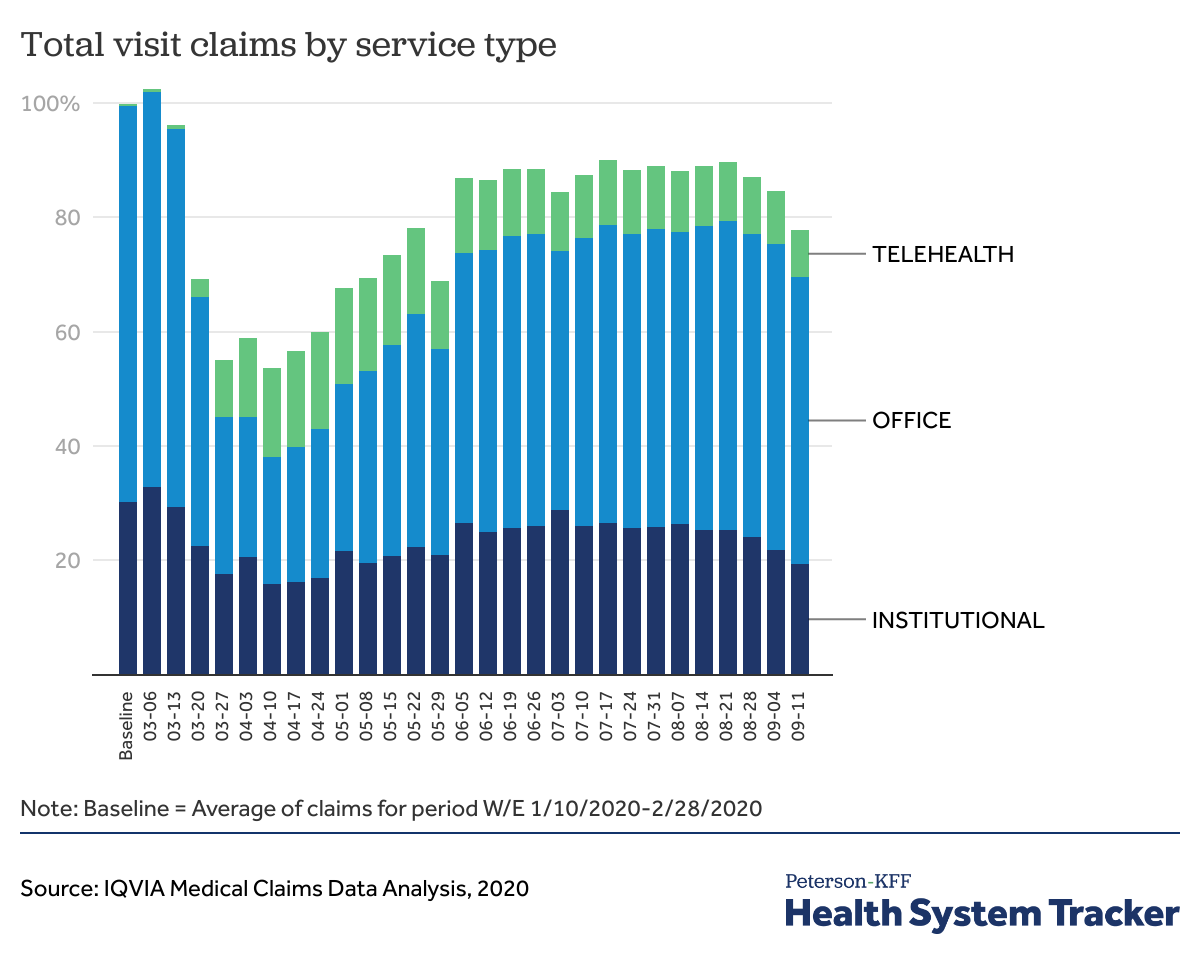

Telemedicine use grew rapidly during the pandemic, merely not enough to showtime drops in in-person part visits

Although almost employer health plans cover telemedicine services, our assay found that telemedicine uptake before the coronavirus pandemic remained low. In 2018, 2.four% of large group enrollees who had an outpatient office visit had at least one telemedicine visit.

However, with social distancing, changes to provider payment for telehealth, and recommendations to phone call ahead to providers, telemedicine utilize has increased with the pandemic, co-ordinate to analysis by IQVIA. All the same, every bit the nautical chart above demonstrates, telehealth use was not large plenty to fully first the drop in in-person intendance. (Before analyses from Epic Health Research Network, Off-white Health, and CVS Health all show abrupt increases in telemedicine use relative to the period earlier the pandemic.)

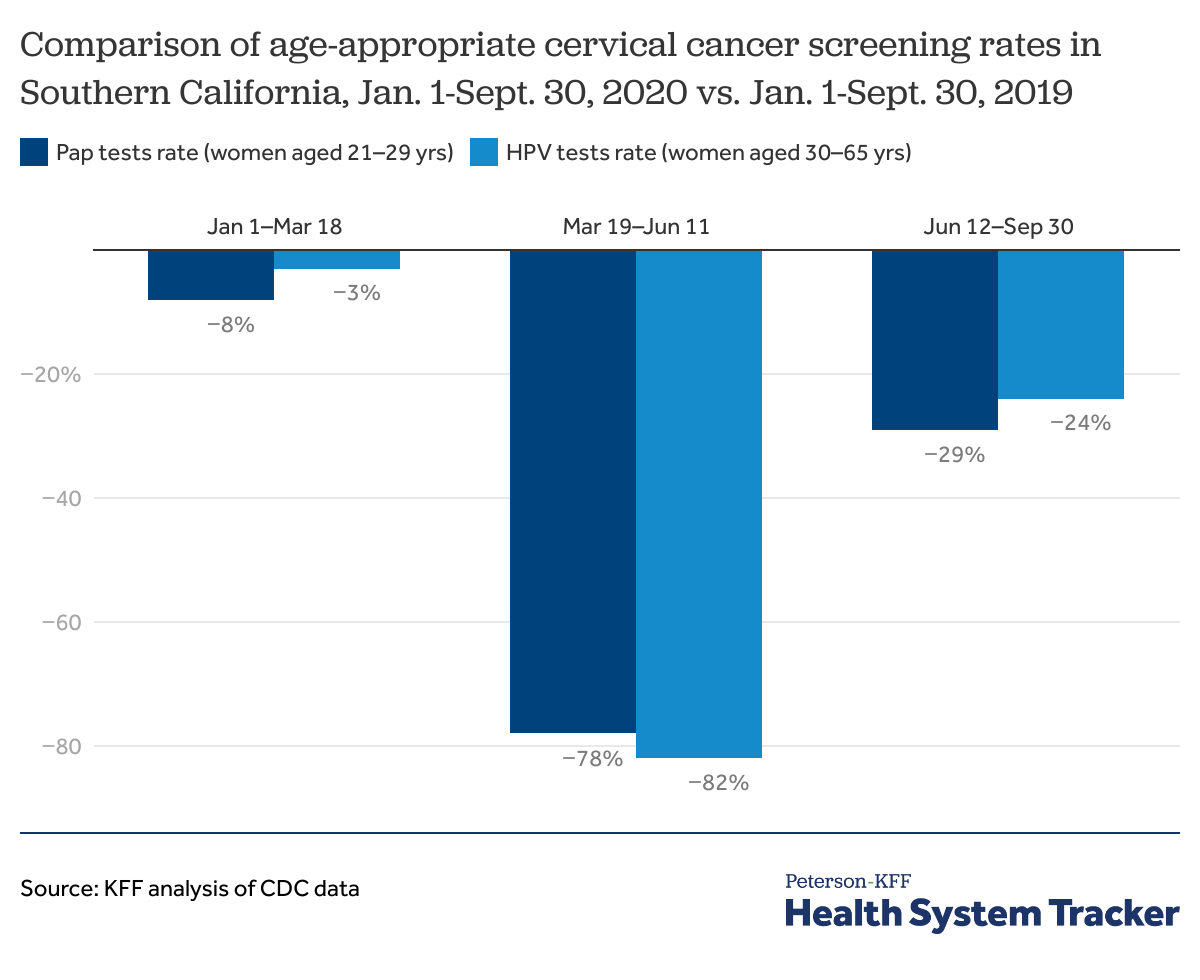

In that location was a drop in preventive services utilization through the third quarter of 2020

The CDC's data on the utilization of historic period-appropriate women's cervical cancer screening among women insured through Kaiser Permanente Southern California shows preventive services utilization rebounded but was considerably below the pre-pandemic levels. During March xix-June eleven of 2020, there was a 78% and 82% drop in cervical cancer screenings for women aged 21-29 years and women aged thirty-65 years, respectively, relative to the same time period in 2019. During June 12-Septembre thirty of 2020, preventive services utilization remained 29% and 24% below 2019 levels for aged 21-29 years and women aged xxx-65 years, respectively.

According to an analysis of electronic wellness records by Epic Health Research Network, the average weekly screenings for breast, colon, and cervical cancers dropped 94%, 86%, and 94% during January xx – April 21, 2020 relative to the averages before January 20, 2020. An analysis past IQVIA establish that oncology visits for newly diagnosed cancer patients began to increase in summer, but and had still not reached baseline in October. If cancer cases are missed or patients are diagnosed at after stages, this could have long-term impacts on both health outcomes and costs. Similar patterns tin can be seen for other serious and chronic diseases. The sustained subtract in wellness services utilization, including preventive services, may lead to more serious diagnoses and increased affliction burden in the future.

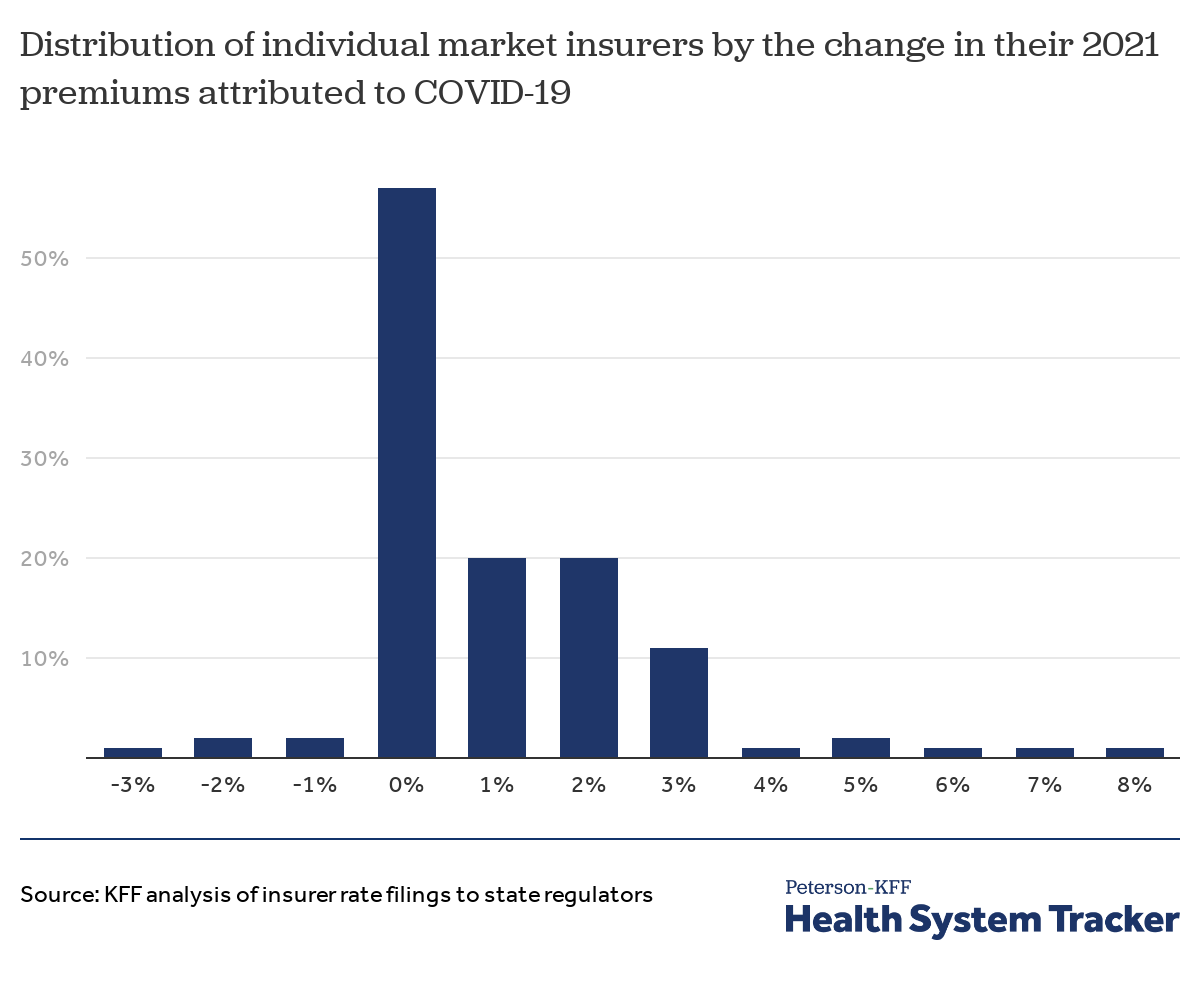

With uncertain brusque and long-term furnishings of COVID-xix, many insurers held 2021 premiums apartment

Individual market insurers are required to file detailed premium justifications to state regulators for the coming year. We analyzed these filings to appraise the effect COVID-19 will have on 2021 premiums. In their rate filings, virtually insurers pointed to remaining incertitude surrounding pent-upwardly demand for delayed or forgone health services in 2020, the costs associated with distributing coronavirus vaccinations, and the direct costs of treating people with COVID-xix. Of those insurers that specified a rate affect due to the pandemic, virtually said the pandemic would have a net-zero event on their costs in 2021, with some insurers proverb they expect costs to drop and others expecting costs to increment. This variation in expectations across insurers illustrates the remaining dubiousness of how the pandemic will continue to impact the U.S. health system in the coming twelvemonth and across.

Equally the year 2020 progressed, it became clear private health insurers were likely profitable from the pandemic's suppressed healthcare spending, and that many insurers would probable owe significant Medical Loss Ratio rebates under the Affordable Intendance Act. In response, a number of insurers preemptively offered premium relief and voluntarily waived cost-sharing for COVID-xix handling and certain other services.

The Peterson Center on Healthcare and KFF are partnering to monitor how well the U.Due south. healthcare arrangement is performing in terms of quality and cost.

![]()

![]()

Source: https://www.healthsystemtracker.org/chart-collection/how-have-healthcare-utilization-and-spending-changed-so-far-during-the-coronavirus-pandemic/

0 Response to "Post-kaiser Family Foundation Poll April 13-may 1, 2017,"

Post a Comment